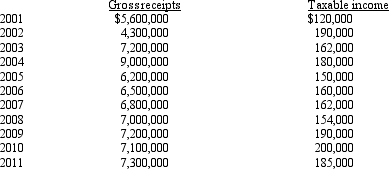

Sage,Inc.,has the following gross receipts and taxable income:

Is Sage,Inc.,subject to the AMT in 2011?

Is Sage,Inc.,subject to the AMT in 2011?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Which of the following statements is correct?

A)A

Q90: Caroline and Clint are married,have no dependents,and

Q91: Smoke,Inc.,provides you with the following information:

Q92: Use the following selected data to calculate

Q93: Frederick sells land and building whose adjusted

Q95: Cindy,who is single and has no dependents,has

Q96: Calico,Inc.,has AMTI of $305,000.Calculate the amount of

Q97: In May 2010,Egret,Inc.issues options to Andrea,a corporate

Q98: Sand Corporation,a calendar year taxpayer,has alternative minimum

Q99: Calculate the AMT exemption for 2011 if

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents