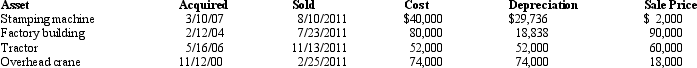

The chart below describes the § 1231 assets sold by the Tan Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $14,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Ranja acquires $200,000 face value corporate bonds

Q123: In early 2010,Wilma paid $56,000 for an

Q124: A business machine purchased April 10,2010,for $62,000

Q125: A business taxpayer sold all the depreciable

Q127: Residential real estate was purchased in 2008

Q129: Harold lent $200,000 to a close personal

Q130: A business taxpayer sold all the depreciable

Q131: Jason (now 37 years old)owns a collection

Q132: In 2011 Angela,a single taxpayer with no

Q133: Betty,a single taxpayer with no dependents,has the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents