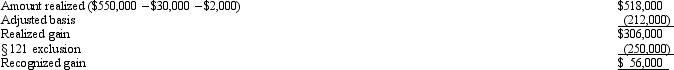

On January 5,2011,Bill sells his principal residence with an adjusted basis of $212,000 for $550,000.He has owned and occupied the residence for 18 years.He pays $30,000 in commissions and $2,000 in legal fees in connection with the sale.One month before the sale,Bill painted the exterior of the house at a cost of $5,000 and repaired various items at a cost of $3,000.On October 15,2011,Bill purchases a new home for $525,000.On November 15,2012,he pays $25,000 for completion of a new room on the house,and on January 14,2013,he pays $15,000 for the construction of a pool.What is the Bill's recognized gain on the sale of his old principal residence and what is the basis for the new residence?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: Justin owns 1,000 shares of Oriole Corporation

Q26: Sandy and Greta form Tan,Inc.by transferring the

Q27: For each of the following involuntary conversions,determine

Q28: Evelyn's office building is destroyed by fire

Q31: Don,who is single,sells his personal residence on

Q32: Eunice Jean exchanges land held for investment

Q33: Patty's factory building,which has an adjusted basis

Q34: Lucinda,a calendar year taxpayer,owned a rental property

Q35: a.Orange Corporation exchanges a warehouse located in

Q207: Monica sells a parcel of land to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents