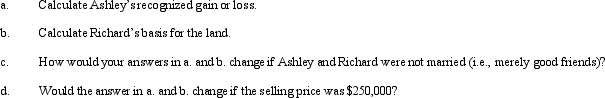

Ashley sells investment land (adjusted basis of $190,000)that she has owned for 4 years to her husband,Richard,for its fair market value of $175,000.

Correct Answer:

Verified

Q27: After 5 years of marriage, Dave and

Q42: Describe the relationship between the recovery of

Q52: Maurice sells his personal use automobile at

Q58: Taylor owns common stock in Taupe,Inc.,with an

Q202: Under what circumstances will a distribution by

Q209: Joseph converts a building (adjusted basis of

Q212: Discuss the effect of a liability assumption

Q216: When a property transaction occurs, what four

Q243: What is the difference between the depreciation

Q254: Define fair market value as it relates

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents