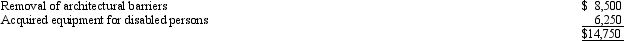

Golden Corporation is an eligible small business for purposes of the disabled access credit.During the year,Golden makes the following expenditures on a structure originally placed in service in 1988.

In addition,$8,000 was expended by Golden on a building originally placed in service in the current year to ensure easy accessibility by disabled individuals.Calculate the amount of the disabled access credit available to Golden Corporation.

In addition,$8,000 was expended by Golden on a building originally placed in service in the current year to ensure easy accessibility by disabled individuals.Calculate the amount of the disabled access credit available to Golden Corporation.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Which of the following statements is true

Q84: Summer Corporation's business is international in scope

Q86: In May 2011,Blue Corporation hired Camilla,Jolene,and Tyrone,all

Q88: Bradley has two college-age children,Clint,a freshman at

Q89: Explain the purpose of the tax credit

Q97: Discuss the treatment of unused general business

Q100: Explain the purpose of the disabled access

Q100: Realizing that providing for a comfortable retirement

Q104: Dabney and Nancy are married, both gainfully

Q119: Steve has a tentative general business credit

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents