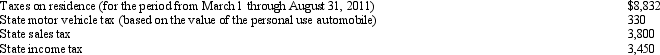

During 2011,Ellen paid the following taxes:  Ellen sold her personal residence on May 30,2011,under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for 2011 for Ellen?

Ellen sold her personal residence on May 30,2011,under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for 2011 for Ellen?

A) $12,962.

B) $11,900.

C) $8,450.

D) $4,650.

E) None of the above.

Correct Answer:

Verified

Q48: Employee business expenses for travel qualify as

Q51: Contributions to public charities in excess of

Q55: John gave $1,000 to a family whose

Q57: Gambling losses may be deducted to the

Q58: In order to dissuade his pastor from

Q63: Your friend Scotty informs you that he

Q64: Tom is advised by his family physician

Q65: Joseph and Sandra,married taxpayers,took out a mortgage

Q66: David, a single taxpayer, took out a

Q66: In 2011,Terry pays $10,000 to become a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents