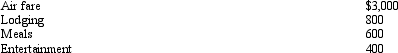

During the year,Peggy went from Nashville to Quito (Ecuador) on business.She spent four days on business,two days on travel,and four days on vacation.Disregarding the vacation costs,Peggy's unreimbursed expenses are:  Peggy's deductible expenses are:

Peggy's deductible expenses are:

A) $2,500.

B) $2,800.

C) $3,100.

D) $4,300.

E) None of the above.

Correct Answer:

Verified

Q67: Employees who render an adequate accounting to

Q69: Aaron is a self-employed practical nurse who

Q72: During the year,Walt went from Louisville to

Q72: A taxpayer who claims the standard deduction

Q79: Ryan performs services for Jordan. Which, if

Q86: Which, if any, of the following factors

Q91: A worker may prefer to be classified

Q93: When using the automatic mileage method, which,

Q94: Allowing for the cutback adjustment (50% reduction

Q100: A worker may prefer to be treated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents