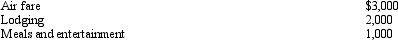

During the year,Oscar travels from Raleigh to Moscow (Russia) on business.His time was spent as follows: 2 days travel (one day each way) ,2 days business,and 2 days personal.His expenses for the trip were as follows (meals and lodging reflect only the business portion) :  Presuming no reimbursement,Oscar's deductible expenses are:

Presuming no reimbursement,Oscar's deductible expenses are:

A) $6,000.

B) $5,500.

C) $4,500.

D) $3,500.

E) None of the above.

Correct Answer:

Verified

Q65: The Federal per diem rates that can

Q69: For self-employed taxpayers, travel expenses are not

Q69: Aaron is a self-employed practical nurse who

Q72: A taxpayer who claims the standard deduction

Q72: During the year,Walt went from Louisville to

Q75: Corey performs services for Sophie. Which, if

Q92: Under the actual cost method, which, if

Q93: When using the automatic mileage method, which,

Q94: Allowing for the cutback adjustment (50% reduction

Q96: Dave is the regional manager for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents