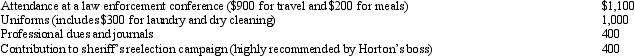

For the current year,Horton was employed as a deputy sheriff of a county.He had AGI of $50,000 and the following unreimbursed employee expenses:

How much of these expenses are allowed as deductions from AGI?

How much of these expenses are allowed as deductions from AGI?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: Myra's classification of those who work for

Q110: Jacob is a landscape architect who works

Q115: Elsie lives and works in Detroit. She

Q121: A taxpayer just changed jobs and incurred

Q122: Regarding tax favored retirement plans for employees

Q123: Christopher just purchased an automobile for $40,000

Q123: In connection with the office in the

Q125: In terms of income tax treatment, what

Q125: In terms of IRS attitude,what do the

Q163: Tom owns and operates a lawn maintenance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents