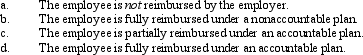

Discuss the 2%-of-AGI floor and the 50% cutback limitation in connection with various employee expenses under the following arrangements:

Correct Answer:

Verified

Q108: Once set for a year, when might

Q113: How are combined business/pleasure trips treated for

Q117: When is a taxpayer's work assignment in

Q121: Ashley and Matthew are husband and wife

Q131: Travel status requires that the taxpayer be

Q137: Regarding § 222 (qualified higher education deduction

Q138: Faith just graduated from college and she

Q139: Nicole just retired as a partner in

Q140: Felicia,a recent college graduate,is employed as an

Q142: Meg teaches the fifth grade at a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents