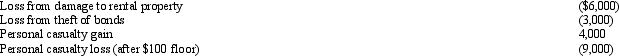

In 2012,Morley,a single taxpayer,had an AGI of $30,000 before considering the following items:  Determine the amount of Morley's itemized deduction from the losses.

Determine the amount of Morley's itemized deduction from the losses.

A) $0.

B) $2,900.

C) $5,120.

D) $5,600.

E) None of the above.

Correct Answer:

Verified

Q48: Which of the following events would produce

Q57: On July 20, 2010, Matt (who files

Q63: In 2012,Juan's home was burglarized.Juan had the

Q63: Regarding research and experimental expenditures, which of

Q64: Last year,Green Corporation incurred the following expenditures

Q66: Bruce,who is single,had the following items for

Q69: Alma is in the business of dairy

Q71: In 2012,Theo,an employee,had a salary of $30,000

Q72: Jim had a car accident in 2012

Q73: Ivory, Inc., has taxable income of $600,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents