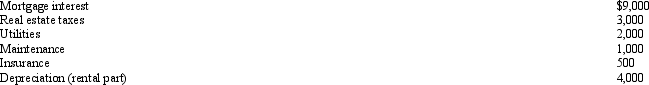

Robyn rents her beach house for 60 days and uses it for personal use for 30 days during the year.The rental income is $6,000 and the expenses are as follows:  Using the IRS approach,total expenses that Robyn can deduct on her tax return associated with the beach house are:

Using the IRS approach,total expenses that Robyn can deduct on her tax return associated with the beach house are:

A) $0.

B) $6,000.

C) $8,000.

D) $12,000.

E) None of the above.

Correct Answer:

Verified

Q82: Velma and Josh divorced.Velma's attorney fee of

Q82: Because Scott is three months delinquent on

Q82: Which of the following is relevant in

Q84: Melba incurred the following expenses for her

Q84: For an activity classified as a hobby,

Q85: Austin,a single individual with a salary of

Q93: Nikeya sells land (adjusted basis of $120,000)

Q96: If a residence is used primarily for

Q98: On January 2, 2012, Fran acquires a

Q100: Robin and Jeff own an unincorporated hardware

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents