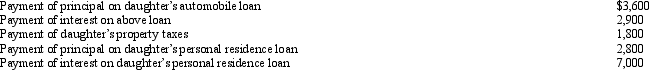

Melba incurred the following expenses for her dependent daughter during the current year:  How much may Melba deduct in computing her itemized deductions?

How much may Melba deduct in computing her itemized deductions?

A) $0.

B) $8,800.

C) $11,700.

D) $18,100.

E) None of the above.

Correct Answer:

Verified

Q79: Petal,Inc.is an accrual basis taxpayer.Petal uses the

Q80: Which of the following expenses associated with

Q82: Velma and Josh divorced.Velma's attorney fee of

Q82: Because Scott is three months delinquent on

Q84: For an activity classified as a hobby,

Q85: Austin,a single individual with a salary of

Q86: Robyn rents her beach house for 60

Q93: Nikeya sells land (adjusted basis of $120,000)

Q96: If a residence is used primarily for

Q98: On January 2, 2012, Fran acquires a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents