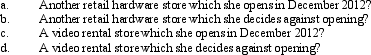

Gladys owns a retail hardware store in Tangipahoa.She is considering opening a business in Hammond,a community located 25 miles away.She incurs expenses of $60,000 in 2012 in investigating the feasibility and desirability of doing so.What amount can Gladys deduct in 2012 if the business is:

Correct Answer:

Verified

Q84: Beige, Inc., an airline manufacturer, is conducting

Q112: Alfred's Enterprises,an unincorporated entity,pays employee salaries of

Q113: Bridgett's son,Hubert,is $10,000 in arrears on his

Q114: Sandra owns an insurance agency.The following selected

Q115: Janet is the CEO for Silver, Inc.,

Q116: Albie operates an illegal drug-running business and

Q119: Rose's business sells air conditioners which have

Q120: Walter sells land with an adjusted basis

Q122: If part of a shareholder/employee's salary is

Q123: If a taxpayer operated an illegal business

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents