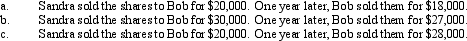

Sandra sold 500 shares of Wren Corporation to Bob,her brother,for its fair market value.She had paid $26,000 for the stock.Calculate Sandra's and Bob's gain or loss under the following circumstances:

Correct Answer:

Verified

Q81: If a vacation home is determined to

Q90: Which of the following must be capitalized

Q96: Cory incurred and paid the following expenses:

Q97: Which of the following is not deductible?

A)Moving

Q98: Priscella pursued a hobby of making bedspreads

Q102: Calculate the net income includible in taxable

Q102: During the year, Jim rented his vacation

Q102: Taylor, a cash basis architect, rents the

Q103: Kitty runs a brothel (illegal under state

Q106: While she was a college student,Juliet worked

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents