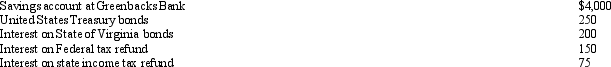

Doug and Pattie received the following interest income in the current year:  Greenbacks Bank also gave Doug and Pattie a cellular phone (worth $100) for opening the savings account.What amount of interest income should they report on their joint income tax return?

Greenbacks Bank also gave Doug and Pattie a cellular phone (worth $100) for opening the savings account.What amount of interest income should they report on their joint income tax return?

A) $4,775.

B) $4,675.

C) $4,575.

D) $4,300.

E) None of the above.

Correct Answer:

Verified

Q81: Martha participated in a qualified tuition program

Q84: Tonya is a cash basis taxpayer.In 2012,

Q88: In December 2012, Todd, a cash basis

Q90: Flora Company owed $95,000, a debt incurred

Q91: Sandy is married,files a joint return,and expects

Q93: The exclusion of interest on educational savings

Q95: Beverly died during the current year. At

Q96: Harold bought land from Jewel for $150,000.Harold

Q97: Stuart owns 300 shares of Turquoise Corporation

Q98: Denny was neither bankrupt nor insolvent but

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents