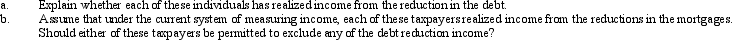

Sally and Ed each own property with a fair market value less than the amount of the outstanding mortgage on the property and also less than the original cost basis.They each were able to convince the mortgage holder to reduce the principal amount on the mortgage.Sally's mortgage is on her personal residence and Ed's mortgage is on rental property he owns.

Correct Answer:

Verified

Q93: The exclusion of interest on educational savings

Q95: Beverly died during the current year. At

Q97: George is employed by the Quality Appliance

Q99: George,an unmarried cash basis taxpayer,received the following

Q100: Barbara was injured in an automobile accident.She

Q101: The CEO of Cirtronics Inc., discovered that

Q104: What are the tax problems associated with

Q104: Sonja is a United States citizen who

Q108: Gull Corporation was undergoing reorganization under the

Q112: What Federal income tax benefits are provided

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents