Related Questions

Q123: Deductions for AGI are often referred to

Q124: Mr. Lee is a citizen and resident

Q126: During 2012,Madison had salary income of $80,000

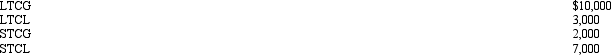

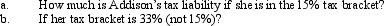

Q129: During 2012,Jackson had the following capital gains

Q132: In order to claim a dependency exemption

Q135: When filing their Federal income tax returns,the

Q145: Adjusted gross income (AGI) sets the ceiling

Q146: Mel is not quite sure whether an

Q150: In applying the gross income test in

Q158: Under what circumstances, if any, may an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents