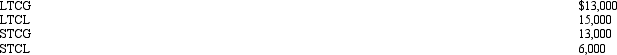

During 2012,Madison had salary income of $80,000 and the following capital transactions:

How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: During the year,Irv had the following transactions:

Q124: The Dargers have itemized deductions that exceed

Q124: Mr. Lee is a citizen and resident

Q129: During 2012,Jackson had the following capital gains

Q131: During 2012,Addison has the following gains and

Q132: In order to claim a dependency exemption

Q134: In satisfying the support test and the

Q137: The Deweys are expecting to save on

Q146: Mel is not quite sure whether an

Q152: During the current year, Doris received a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents