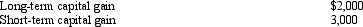

In 2011,Creeper Corporation had a $4,000 net long-term capital loss which it could not carry back.For 2012,it had the following capital transactions:  As a result of these transactions,for 2012 Creeper has a:

As a result of these transactions,for 2012 Creeper has a:

A) Net short-term capital gain of $1,000.

B) Net short-term capital gain of $3,000.

C) Net long-term capital gain of $1,000.

D) Carryover to 2013 of $2,000 long-term capital loss.

E) None of the above.

Correct Answer:

Verified

Q84: Which of the following, if any, correctly

Q84: In comparing regular (C)corporations with individuals,which of

Q85: Gray is a calendar year taxpayer.In early

Q86: Which,if any,of the following rules relate only

Q89: Aiden and Addison form Dove Corporation with

Q89: Which of the following rules are the

Q90: Two unrelated,calendar year C corporations have the

Q95: Citron Company is a wholesale distributor of

Q98: In the current year,Auburn Corporation (a calendar

Q99: During the current year,Goose Corporation (a calendar

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents