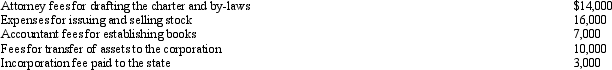

Drab Corporation,a calendar year and cash basis taxpayer,is formed in December 2012.In the same month,expenses are incurred as follows:

Correct Answer:

Verified

Q122: Sophia contributes land to the Tan Partnership

Q127: Four unrelated,calendar year corporations are formed on

Q130: In order to get the Cardinal Corporation

Q131: Azure Corporation,a calendar year taxpayer,has taxable income

Q133: Scarlet Company,a clothing retailer,donates children's clothing to

Q135: Spencer owns 50% of the stock of

Q136: Cerulean Corporation owns 6% of the stock

Q137: For 2011,Plover Corporation,a calendar year taxpayer,had net

Q138: Regarding the check-the-box Regulations,comment on each of

Q139: Starling Corporation is a calendar year S

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents