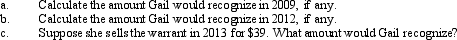

On January 1,2009,Gail (an executive)receives a warrant to purchase one share of stock at $70 and on the same date the fair market value of the stock is $100.The warrant has no restrictions and has a readily ascertainable fair market value on a stock exchange of $30.She exercises the warrant on May 15,2009,and sells the stock for $200 on December 20,2012.

Correct Answer:

Verified

Q73: If the special election under § 83(b)

Q82: Compare a § 401(k) plan with an

Q84: Yvonne exercises incentive stock options (ISOs)for 100

Q85: Under a nonqualified stock option (NQSO)plan which

Q89: From an employee's point of view, discuss

Q92: What is a defined contribution plan?

Q92: A qualified pension and profit sharing plan

Q94: Under what circumstances is it advantageous for

Q95: If a person has funds from sources

Q138: Samuel, age 53, has a traditional deductible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents