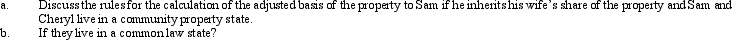

Sam and Cheryl,husband and wife,own property jointly.The property has an adjusted basis of $400,000 and a fair market value of $500,000.

Correct Answer:

Verified

Q56: What is a deathbed gift and what

Q58: For gifts made after 1976, when will

Q62: Mitchell owned an SUV that he had

Q222: Discuss the application of holding period rules

Q228: What is the easiest way for a

Q232: Explain how the sale of investment property

Q235: Identify two tax planning techniques that can

Q240: Tariq sold certain U.S. Government bonds and

Q246: How is the donee's basis calculated for

Q257: For disallowed losses on related-party transactions, who

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents