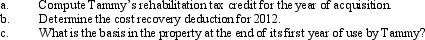

In January 2012,Tammy acquired an office building in downtown Syracuse,New York for $400,000.The building was originally constructed in 1932.Of the $400,000 cost,$40,000 was allocated to the land.Tammy immediately placed the building into service,but quickly realized that substantial renovation would be required to keep and attract new tenants.The renovations,costing $600,000,were of the type that qualifies for the rehabilitation credit.The improvements were completed in October 2012.

Correct Answer:

Verified

Q81: In May 2008, Cindy incurred qualifying rehabilitation

Q84: Pat generated self-employment income in 2012 of

Q87: Identify the statement below that is false.

A)If

Q97: Discuss the treatment of unused general business

Q104: Dabney and Nancy are married, both gainfully

Q106: Susan generated $55,000 of net earnings from

Q108: Bradley has two college-age children, Clint, a

Q109: Phil and Audrey, husband and wife, are

Q111: Ken is married to a nonemployed spouse

Q119: Golden Corporation is an eligible small business

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents