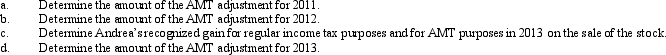

In May 2011,Egret,Inc.issues options to Andrea,a corporate officer,to purchase 200 shares of Egret stock under an ISO plan.At the date the stock options are issued,the fair market value of the stock is $900 per share and the option price is $1,200 per share.The stock becomes freely transferable in 2012.Andrea exercises the options in November 2011 when the stock is selling for $1,600 per share.She sells the stock in December 2013 for $1,800 per share.

Correct Answer:

Verified

Q68: Tad is a vice-president of Ruby Corporation.

Q69: Marvin, the vice president of Lavender, Inc.,

Q72: Vinny's AGI is $220,000.He contributed $130,000 in

Q80: Prior to the effect of tax credits,

Q81: In calculating her taxable income,Rhonda deducts the

Q83: Cindy,who is single and has no dependents,has

Q84: Luke's itemized deductions in calculating taxable income

Q84: Which of the following statements is correct?

A)A

Q87: Smoke,Inc.,provides you with the following information:

Q88: Sand Corporation, a calendar year taxpayer, has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents