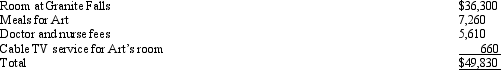

Liz,who is single,travels frequently on business.Art,Liz's 84-year-old dependent grandfather,lived with Liz until this year when he moved to Granite Falls Nursing Home because he needs daily medical and nursing care.During the year,Liz made the following payments to Granite Falls on behalf of Art:  Granite Falls has medical staff in residence.Disregarding the 7.5% floor,how much,if any,of these expenses qualifies as a medical expense deduction by Liz?

Granite Falls has medical staff in residence.Disregarding the 7.5% floor,how much,if any,of these expenses qualifies as a medical expense deduction by Liz?

A) $5,610.

B) $41,910.

C) $49,170.

D) $49,830.

E) None of the above.

Correct Answer:

Verified

Q43: Ronaldo contributed stock worth $12,000 to the

Q45: Jeanne had an accident while hiking on

Q46: Any capital asset donated to a public

Q48: Employee business expenses for travel qualify as

Q50: In the year of her death, Maria

Q51: Contributions to public charities in excess of

Q51: Jerry pays $5,000 tuition to a parochial

Q54: During the year, Eve (a resident of

Q55: John gave $1,000 to a family whose

Q60: Gambling losses may be deducted to the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents