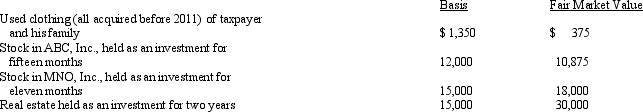

Zeke made the following donations to qualified charitable organizations during 2012:  The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2012 is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2012 is:

A) $43,350.

B) $56,250.

C) $59,250.

D) $60,375.

E) None of the above.

Correct Answer:

Verified

Q44: The reduced deduction election enables a taxpayer

Q50: In the year of her death, Maria

Q56: Fred and Lucy are married and together

Q59: Roger is employed as an actuary.For calendar

Q60: Gambling losses may be deducted to the

Q61: Emily, who lives in Indiana, volunteered to

Q62: In 2012, Boris pays a $3,800 premium

Q63: During 2012,Nancy paid the following taxes:

Q65: Karen,a calendar year taxpayer,made the following donations

Q66: David, a single taxpayer, took out a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents