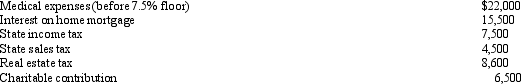

George is single,has AGI of $255,300,and incurs the following expenditures in 2012.

What is the amount of itemized deductions George may claim?

What is the amount of itemized deductions George may claim?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Helen pays nursing home expenses of $3,000

Q86: Paul and Patty Black are married and

Q87: Virginia had AGI of $100,000 in 2012.She

Q87: During the current year, Maria and her

Q88: Brian, a self-employed individual, pays state income

Q89: During 2012,Ralph made the following contributions to

Q91: Timothy suffers from heart problems and,upon the

Q93: Marilyn is employed as an architect.For calendar

Q94: During 2012, Kathy, who is self-employed, paid

Q96: In 2005, Ross, who is single, purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents