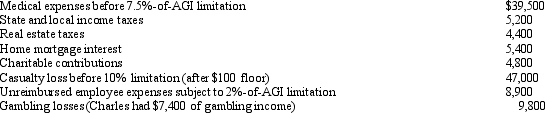

Charles,who is single,had AGI of $400,000 during 2012.He incurred the following expenses and losses during the year.

Compute Charles's total itemized deductions for the year.

Compute Charles's total itemized deductions for the year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Harry and Sally were divorced three years

Q82: Helen pays nursing home expenses of $3,000

Q83: Samuel, an individual who has been physically

Q90: In 2012, Shirley sold her personal residence

Q96: For calendar year 2012,Jon and Betty Hansen

Q96: In 2005, Ross, who is single, purchased

Q100: Paul,a calendar year married taxpayer,files a joint

Q101: Linda borrowed $60,000 from her parents for

Q104: Frank, a widower, had a serious stroke

Q105: The City of Ogden was devastated by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents