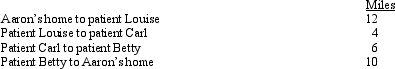

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

A) 10 miles.

B) 12 miles.

C) 20 miles.

D) 22 miles.

E) 32 miles.

Correct Answer:

Verified

Q55: The portion of the office in the

Q62: During the year,Peggy went from Nashville to

Q63: During the year,Walt went from Louisville to

Q67: Amy works as an auditor for a

Q67: Employees who render an adequate accounting to

Q69: For self-employed taxpayers, travel expenses are not

Q70: Aiden is the city sales manager for

Q86: Which, if any, of the following factors

Q91: A worker may prefer to be classified

Q96: Dave is the regional manager for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents