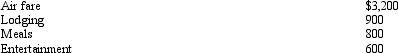

During the year,Walt went from Louisville to Hawaii on business.Preceding a five-day business meeting,he spent four days vacationing at the beach.Excluding the vacation costs,his expenses for the trip are:  Presuming no reimbursement,deductible expenses are:

Presuming no reimbursement,deductible expenses are:

A) $5,500.

B) $4,800.

C) $3,900.

D) $3,200.

E) None of the above.

Correct Answer:

Verified

Q44: Every year, Penguin Corporation gives each employee

Q50: As Christmas presents, Lily sends gift certificates

Q55: The portion of the office in the

Q62: During the year,Peggy went from Nashville to

Q65: Aaron is a self-employed practical nurse who

Q67: Amy works as an auditor for a

Q67: Employees who render an adequate accounting to

Q69: For self-employed taxpayers, travel expenses are not

Q86: Which, if any, of the following factors

Q91: A worker may prefer to be classified

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents