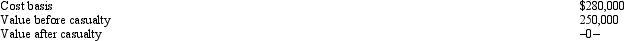

In 2012,Grant's personal residence was damaged by fire.Grant was insured for 90% of his actual loss,and he received the insurance settlement.Grant had adjusted gross income,before considering the casualty item,of $30,000.Pertinent data with respect to the residence follows:  What is Grant's allowable casualty loss deduction?

What is Grant's allowable casualty loss deduction?

A) $0.

B) $6,500.

C) $6,900.

D) $10,000.

E) $80,000.

Correct Answer:

Verified

Q44: The excess of nonbusiness capital gains over

Q52: Five years ago, Tom loaned his son

Q56: On September 3, 2011, Able, a single

Q62: In 2012,Theo,an employee,had a salary of $30,000

Q63: Regarding research and experimental expenditures, which of

Q66: Alicia was involved in an automobile accident

Q66: Blue Corporation incurred the following expenses in

Q67: Bruce,who is single,had the following items for

Q69: Alma is in the business of dairy

Q74: Norm's car, which he uses 100% for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents