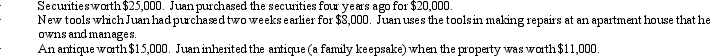

In 2012,Juan's home was burglarized.Juan had the following items stolen:  Juan's homeowner's policy had a $50,000 deductible clause for thefts.If Juan's salary for the year is $50,000,determine the amount of his itemized deductions as a result of the theft.

Juan's homeowner's policy had a $50,000 deductible clause for thefts.If Juan's salary for the year is $50,000,determine the amount of his itemized deductions as a result of the theft.

A) $3,100.

B) $6,000.

C) $26,100.

D) $26,500.

E) None of the above.

Correct Answer:

Verified

Q48: Which of the following events would produce

Q57: On July 20, 2010, Matt (who files

Q61: Last year, Sarah (who files as single)

Q74: Last year,Green Corporation incurred the following expenditures

Q75: In 2012,Morley,a single taxpayer,had an AGI of

Q77: In 2012,Wally had the following insured personal

Q82: Mavis,age 70,is single with no dependents.The following

Q83: Neal,single and age 37,has the following items

Q84: Gary,who is an employee of Red Corporation,has

Q88: Roger, an individual, owns a proprietorship called

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents