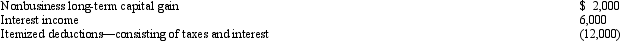

Jack,age 30 and married with no dependents,is a self-employed individual.For 2012,his self-employed business sustained a net loss from operations of $10,000.The following additional information was obtained from his personal records for the year:  Based on the above information,what is Jack's net operating loss for the current year if he and his spouse file a joint return?

Based on the above information,what is Jack's net operating loss for the current year if he and his spouse file a joint return?

A) $2,000.

B) $8,000.

C) $10,000.

D) $11,000.

E) $16,400.

Correct Answer:

Verified

Q94: Bill,age 40,is married with two dependents.Bill had

Q95: Janice,single with one dependent child,had the following

Q96: In the computation of a net operating

Q97: Khalid,who is single,had the following items for

Q98: Steve and Holly have the following items

Q100: Wu,who is single,has the following items for

Q103: Discuss the calculation of nonbusiness deductions for

Q106: A taxpayer who sustains a casualty loss

Q108: Discuss the computation of NOL remaining to

Q109: Identify the factors that should be considered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents