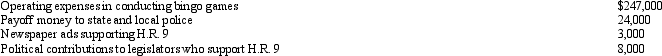

Rex,a cash basis calendar year taxpayer,runs a bingo operation which is illegal under state law.During 2012,a bill designated H.R.9 is introduced into the state legislature which,if enacted,would legitimize bingo games.In 2012,Rex had the following expenses:  Of these expenditures,Rex may deduct:

Of these expenditures,Rex may deduct:

A) $247,000.

B) $250,000.

C) $258,000.

D) $282,000.

E) None of the above.

Correct Answer:

Verified

Q49: Martha rents part of her personal residence

Q57: The portion of property tax on a

Q60: Larry,a calendar year cash basis taxpayer,has the

Q61: Petal,Inc.is an accrual basis taxpayer.Petal uses the

Q62: Andrew,who operates a laundry business,incurred the following

Q64: Which of the following cannot be deducted

Q65: Terry and Jim are both involved in

Q74: Benita incurred a business expense on December

Q77: Which of the following is not a

Q80: Which of the following expenses associated with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents