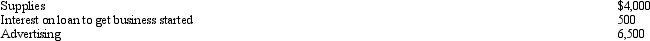

Priscella pursued a hobby of making bedspreads in her spare time.Her AGI before considering the hobby is $40,000.During the year she sold the bedspreads for $10,000.She incurred expenses as follows:  Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

A) Include $10,000 in income and deduct $11,000 for AGI.

B) Ignore both income and expenses since hobby losses are disallowed.

C) Include $10,000 in income, deduct nothing for AGI, and claim $10,000 of the expenses as itemized deductions.

D) Include $10,000 in income and deduct interest of $500 for AGI.

E) None of the above.

Correct Answer:

Verified

Q82: Because Scott is three months delinquent on

Q83: In January, Lance sold stock with a

Q86: Cory incurred and paid the following expenses:

Q89: Austin,a single individual with a salary of

Q90: Bob and April own a house at

Q90: Which of the following must be capitalized

Q92: Robyn rents her beach house for 60

Q93: Arnold and Beth file a joint return.Use

Q96: If a residence is used primarily for

Q100: Robin and Jeff own an unincorporated hardware

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents