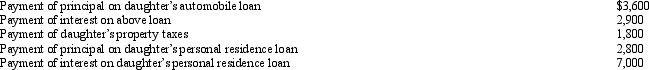

Melba incurred the following expenses for her dependent daughter during the current year:  How much may Melba deduct in computing her itemized deductions?

How much may Melba deduct in computing her itemized deductions?

A) $0.

B) $8,800.

C) $11,700.

D) $18,100.

E) None of the above.

Correct Answer:

Verified

Q61: Which of the following is incorrect?

A) Alimony

Q78: Which of the following is correct?

A)A personal

Q78: Tom operates an illegal drug-running operation and

Q81: If a vacation home is determined to

Q82: Velma and Josh divorced.Velma's attorney fee of

Q86: Cory incurred and paid the following expenses:

Q90: Which of the following must be capitalized

Q93: Nikeya sells land (adjusted basis of $120,000)

Q94: Which of the following is not a

Q96: If a residence is used primarily for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents