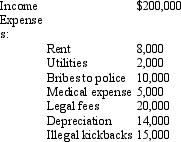

Kitty runs a brothel (illegal under state law)and has the following items of income and expense.What is the amount that she must include in taxable income from her operation?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Which of the following is relevant in

Q82: Because Scott is three months delinquent on

Q84: For an activity classified as a hobby,

Q84: Beige, Inc., an airline manufacturer, is conducting

Q97: Which of the following is not deductible?

A)Moving

Q98: On January 2, 2012, Fran acquires a

Q102: Bridgett's son,Hubert,is $10,000 in arrears on his

Q104: Alfred's Enterprises,an unincorporated entity,pays employee salaries of

Q105: Calculate the net income includible in taxable

Q106: Sandra owns an insurance agency.The following selected

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents