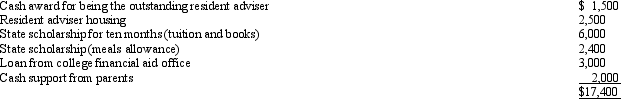

Ron,age 19,is a full-time graduate student at City University.During 2012,he received the following payments:  Ron served as a resident advisor in a dormitory and,therefore,the university waived the $2,500 charge for the room he occupied.What is Ron's adjusted gross income for 2012?

Ron served as a resident advisor in a dormitory and,therefore,the university waived the $2,500 charge for the room he occupied.What is Ron's adjusted gross income for 2012?

A) $1,500.

B) $4,000.

C) $7,500.

D) $15,500.

E) None of the above.

Correct Answer:

Verified

Q34: Roger is in the 35% marginal tax

Q36: Generally,a U.S.citizen is required to include in

Q37: Fresh Bakery often has unsold donuts at

Q41: Jena is a full-time undergraduate student at

Q42: Jack received a court award in a

Q47: Theresa sued her former employer for age,

Q47: Early in the year,Marion was in an

Q49: A scholarship recipient at State University may

Q54: Barney is a full-time graduate student at

Q58: Albert had a terminal illness which required

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents