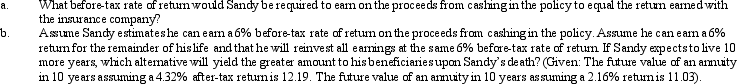

Sandy is married,files a joint return,and expects to be in the 28% marginal tax bracket for the foreseeable future.All of his income is from salary and all of it is used to maintain the household.He has a paid-up life insurance policy with a cash surrender value of $100,000.He paid $60,000 of premiums on the policy.His gain from cashing in the life insurance policy would be ordinary income.If he retains the policy,the insurance company will pay him $3,000 (3%)interest each year.Sandy thinks he can earn a higher return if he cashes in the policy and invests the proceeds.

Correct Answer:

Verified

Q84: Tonya is a cash basis taxpayer.In 2012,

Q87: Emily is in the 35% marginal tax

Q90: Flora Company owed $95,000, a debt incurred

Q93: Barbara was injured in an automobile accident.She

Q93: The exclusion of interest on educational savings

Q96: Harold bought land from Jewel for $150,000.Harold

Q97: Stuart owns 300 shares of Turquoise Corporation

Q98: Denny was neither bankrupt nor insolvent but

Q99: Assuming a taxpayer qualifies for the exclusion

Q101: The CEO of Cirtronics Inc., discovered that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents