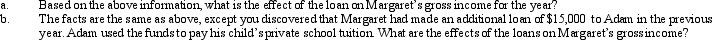

Margaret made a $90,000 interest-free loan to her son,Adam,who used the money to retire a mortgage on his personal residence and to buy a certificate of deposit.Adam's only income for the year is his salary of $35,000 and $1,400 interest income on the certificate of deposit.The relevant Federal interest rate is 8% compounded semiannually.The loan is outstanding for the entire year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: Travis and Andrea were divorced.Their only marital

Q101: Ted loaned money to a business acquaintance.

Q104: The taxable portion of Social Security benefits

Q106: Roy is considering purchasing land for $10,000.He

Q108: Ted and Alice were in the process

Q110: Determine the proper tax year for gross

Q113: On January 1, 2012, Faye gave Todd,

Q114: In January 2012, Tammy purchased a bond

Q117: Our tax laws encourage taxpayers to _

Q120: Katherine is 60 years old and is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents