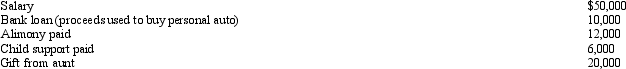

During 2012,Marvin had the following transactions:  Marvin's AGI is:

Marvin's AGI is:

A) $32,000.

B) $38,000.

C) $44,000.

D) $56,000.

E) $64,000.

Correct Answer:

Verified

Q43: For tax purposes, married persons filing separate

Q44: For dependents who have income, special filing

Q47: Currently, the top income tax rate in

Q60: When the kiddie tax applies and the

Q61: During 2012,Esther had the following transactions:

Q64: Which, if any, of the following is

Q65: A child who has unearned income of

Q67: In 2012, Warren sold his personal use

Q78: In terms of the tax formula applicable

Q79: In terms of the tax formula applicable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents