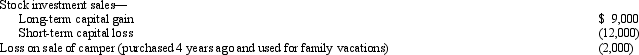

For the current year,David has salary income of $80,000 and the following property transactions:  What is David's AGI for the current year?

What is David's AGI for the current year?

A) $76,000.

B) $77,000.

C) $78,000.

D) $89,000.

E) None of the above.

Correct Answer:

Verified

Q83: Regarding the rules applicable to filing of

Q86: Regarding the Tax Tables applicable to the

Q93: The Hutters filed a joint return for

Q100: During 2012,Jen (age 66)furnished more than 50%

Q100: Arnold is married to Sybil, who abandoned

Q101: Heloise, age 74 and a widow, is

Q103: Warren,age 17,is claimed as a dependent by

Q106: Ashley earns a salary of $55,000,has capital

Q107: Emma had the following transactions for 2012:

Q118: Meg, age 23, is a full-time law

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents