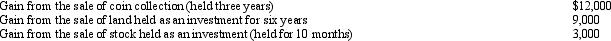

During 2012,Jackson had the following capital gains and losses:

Correct Answer:

Verified

Q122: In resolving qualified child status for dependency

Q123: Deductions for AGI are often referred to

Q124: Mr. Lee is a citizen and resident

Q132: In order to claim a dependency exemption

Q133: When filing their Federal income tax returns,the

Q136: During 2012,Addison has the following gains and

Q140: During the year,Irv had the following transactions:

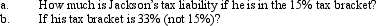

Q143: For 2012,Jackson has taxable income of $30,005.When

Q145: In early 2012, Ben sold a yacht,

Q155: The Martins have a teenage son who

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents