Teal Corporation is incorporated in November 2012.The following formation expenses are incurred in 2012:  Except for the legal and accounting expenses which are paid in 2013,all other expenses are paid in 2012.If Teal Corporation uses the cash basis and adopts a calendar year for tax purposes,the amount of organizational expenditures it can elect to expense for 2012 is:

Except for the legal and accounting expenses which are paid in 2013,all other expenses are paid in 2012.If Teal Corporation uses the cash basis and adopts a calendar year for tax purposes,the amount of organizational expenditures it can elect to expense for 2012 is:

A) $2,000.

B) $5,000.

C) $6,000.

D) $9,000.

E) None of the above.

Correct Answer:

Verified

Q67: The domestic production activities deduction (DPAD) is

Q68: The holding period to the partnership of

Q72: Partnerships are not considered to be separate

Q76: Jordan and his two brothers are equal

Q80: In return for a 10% interest in

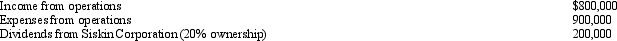

Q82: In the current year,Mockingbird Corporation (a calendar

Q83: Two unrelated,calendar year C corporations have the

Q84: In comparing regular (C)corporations with individuals,which of

Q85: Gray is a calendar year taxpayer.In early

Q86: Which,if any,of the following rules relate only

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents