In December 2012,Oriole Company's board authorizes a cash donation of $30,000 to the Monroe County School District.The amount authorized is paid to the county in two $15,000 amounts in January and February 2013.Presuming a calendar year and accrual method taxpayer,when is the charitable contribution deduction available if Oriole Company is a:

Correct Answer:

Verified

Q120: As of January 1,2012,Donald,the sole shareholder of

Q121: Crimson Corporation owns stock in other C

Q122: Sophia contributes land to the Tan Partnership

Q123: Scarlet Company,a clothing retailer,donates children's clothing to

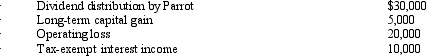

Q126: During 2012,a calendar year taxpayer had the

Q127: Four unrelated,calendar year corporations are formed on

Q128: Arthur forms Catbird Corporation with the following

Q129: Azure Corporation,a calendar year taxpayer,has taxable income

Q130: Rowena is the sole shareholder of Rail,a

Q131: Why were the check-the-box Regulations issued?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents