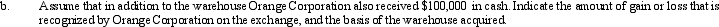

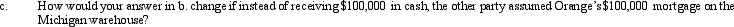

a.Orange Corporation exchanges a warehouse located in Michigan (adjusted basis of $560,000)for a warehouse located in Ohio (adjusted basis of $450,000; fair market value of $525,000).Indicate the amount of gain or loss that is recognized by Orange Corporation on the exchange,and the basis of the warehouse acquired.

Correct Answer:

Verified

Q28: Janet, age 68, sells her principal residence

Q31: On January 5, 2012, Waldo sells his

Q37: Patty's factory building, which has an adjusted

Q39: Don, who is single, sells his personal

Q86: Define qualified small business stock under §

Q112: Samuel's hotel is condemned by the City

Q118: Use the following data to determine the

Q119: Beth sells investment land (adjusted basis of

Q234: What requirements must be satisfied to receive

Q236: Discuss the relationship between the postponement of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents