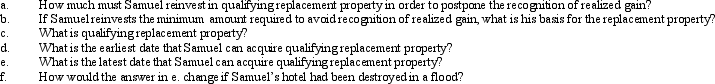

Samuel's hotel is condemned by the City Housing Authority on July 5,2012,for which he is paid condemnation proceeds of $950,000.He first received official notification of the pending condemnation on May 2,2012.Samuel's adjusted basis for the hotel is $600,000 and he uses a fiscal year for tax purposes with a September 30 tax year-end.

Correct Answer:

Verified

Q27: After 5 years of marriage, Dave and

Q28: Janet, age 68, sells her principal residence

Q32: Evelyn's office building is destroyed by fire

Q37: Patty's factory building, which has an adjusted

Q39: Don, who is single, sells his personal

Q107: Eunice Jean exchanges land held for investment

Q108: Mandy and Greta form Tan,Inc.,by transferring the

Q116: a.Orange Corporation exchanges a warehouse located in

Q234: What requirements must be satisfied to receive

Q236: Discuss the relationship between the postponement of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents