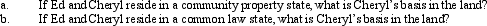

Ed and Cheryl have been married for 27 years.They own land jointly with a basis of $300,000.Ed dies in 2012,when the fair market value of the land is $500,000.Under the joint ownership arrangement,the land passed to Cheryl.

Correct Answer:

Verified

Q17: Boyd acquired tax-exempt bonds for $430,000 in

Q42: Describe the relationship between the recovery of

Q88: Nigel purchased a blending machine for $125,000

Q117: Misty owns stock in Violet,Inc.,for which her

Q118: On September 18,2012,Jerry received land and a

Q197: Hilary receives $10,000 for a 15-foot wide

Q204: If a taxpayer purchases a business and

Q208: For a corporate distribution of cash or

Q241: What effect does a deductible casualty loss

Q252: Define a bargain purchase of property and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents