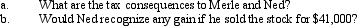

On January 15 of the current taxable year,Merle sold stock with a cost of $40,000 to his brother Ned for $25,000,its fair market value.On June 21,Ned sold the stock to a friend for $26,000.

Correct Answer:

Verified

Q36: Lynn transfers her personal use automobile to

Q133: Justin owns 1,000 shares of Oriole Corporation

Q201: What is the general formula for calculating

Q202: Under what circumstances will a distribution by

Q207: Monica sells a parcel of land to

Q216: When a property transaction occurs, what four

Q217: Maurice sells his personal use automobile at

Q243: What is the difference between the depreciation

Q252: Define a bargain purchase of property and

Q254: Define fair market value as it relates

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents